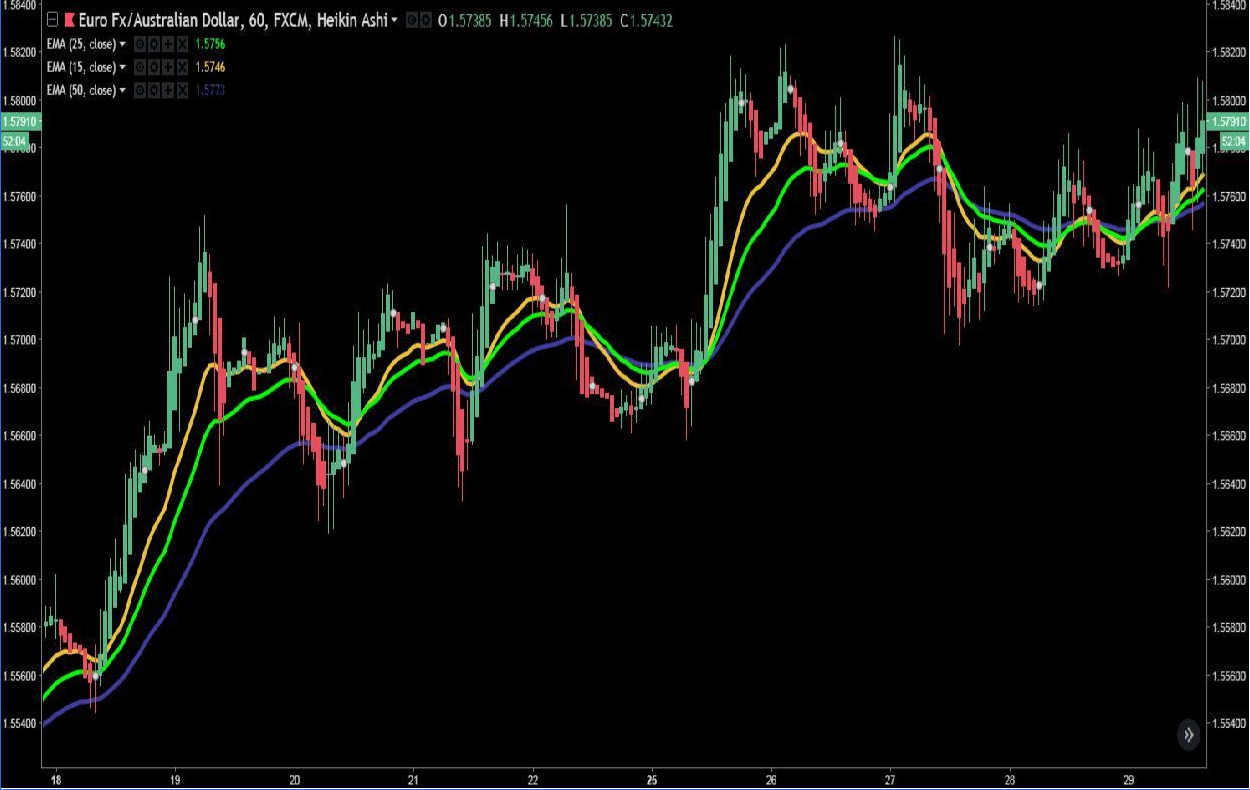

Step 6: Book your profit once we break and close below the 50 EMA:.Step 5: Place your stop loss 20 points below the 50 EMA:.Step 4: Buy at the market when we retest the 20 and 50 EMA zone for the third time:.Step 3: Wait for the zone between 20 and 50 EMA to be tested twice, then look for your trade opportunities:.Step 2: Wait for EMA crossover and for the prices to trade above 20 and 50 EMA:.Step 1: Plot 20 and 50 EMA on your chart for Best EMA strategy for Intraday:.Trading Rules or General steps to use Best EMA strategy for Intraday:.When should you use the Exponential Moving Average (EMA)?.Calculating Exponential Moving Average (EMA):.What time period is best for calculating EMA?.But when we use SMA, it isn’t as sticky as EMA. So, when EMA strategy uses to pullbacks, it make the market seem like it is bouncing off the EMAs. When you plot the EMA and SMA on the same chart, you may notice that EMA stick closer to price. So, the EMA is the best way to trade pullbacks.Įven though there are many types of moving strategies in forex trading, most commonly used strategies are EMA and SMA (Simple Moving Average).

These pullbacks are great opportunities for traders to get into a trade before the market resumes its trends. In this situation, lower highs are the pullbacks. When we turn in to the other side, it means if there is a downtrend, they form lower lows and lower highs. So, the higher lows consider as the pullbacks. When markets are in a high position of an economy (uptrend), they form higher highs and higher lows. Always there is a rest period before continuing the trend. Pullbacks also name as retracements, and this is one of the most popular trading strategies since they usually don’t go up in a straight line.

#Ema trading how to#

EMA in Forex Trading How to use EMA to Trade Pullbacks In this situation, the trader will buy when 12-day EMA crosses above the 26-day EMA while selling when the 12-day EMA crosses below the 26-day EMA. If the short term EMA crosses above a long time EMA, it is an uptrend market, and if the short term EMA crosses below the long term EMA, it usually is known as a downtrend.Īs an example, a longer-term trader may use 12-day EMA as a short term average and 26-day EMA as the long-term trend line. This strategy creates a trading signal when the shorter EMA crosses the longer one. It means, one short-term and one long-term EMA. If we calculate daily EMA, we can derive the current value of the previous day’s EMA.Īs mentioned earlier, a more effective way of reading the EMA cross is by using a double exponential moving average combination. So, to calculate EMA for a specific time require the previous calculations of EMA. Ɑ is a smoothing constant in which the value between 0 and 1.ĮMAt-1 is the EMA for the previous period. Usually, EMA calculate at the time (t), and the formula of an exponential moving average is as follows:ĮMAt= ɑ x current price + (1- ɑ) x EMAt-1 To a part of the value of the previous moving average. EMA is adding a portion of the current price. EMA leads to calculating the average of the values by looking back at a recent number of data points. Traders use this to smooth the variations in data to determine the underlying trend. Read More The Best Forex Strategy for You in 2020.This strategy gives more weight to the recent data and also EMA reacts faster to current prices than SMA. Or else, traders move into sell orders when the short period EMA crosses below the long term EMA. After considering all these things, a trader enters to buy orders when the short term EMA crosses over the long term EMA. Then the trade base on the position of the short term EMA concerning the long term EMA.

When a forex trading using this EMA, it relies on selecting shorter-term EMA and a longer-term EMA. Simple Moving Average (SMA) This is a result of the This helps to determine entry and exit points of the trade base on the place of price action sit on the trading chart. EMA gives the meaning of Exponential Moving Average, and this is one of the most commonly used forex trading strategies.

0 kommentar(er)

0 kommentar(er)